2024 Schedule 1 2024 Self-Employment Tax – The IRS has partnered with eight online tax software providers in 2024 as part of its as our top choice for self-employment taxes is that as of Feb. 1 it costs just under $93 to file a state . There are many valuable self-employment tax deductions for freelancers, contractors and other self-employed people who work for themselves. Here are 15 big ones to remember ahead of tax day. .

2024 Schedule 1 2024 Self-Employment Tax

Source : wallethacks.comAmazon.com: tax year diary 2024 2025: A5 Financial year diary week

Source : www.amazon.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comCalling all 1099 Self Employed: The Self Employment Tax Credit is

Source : www.linkedin.comSelf Employed Tax Credit: SETC 2024 | .SETC.me Gig Worker

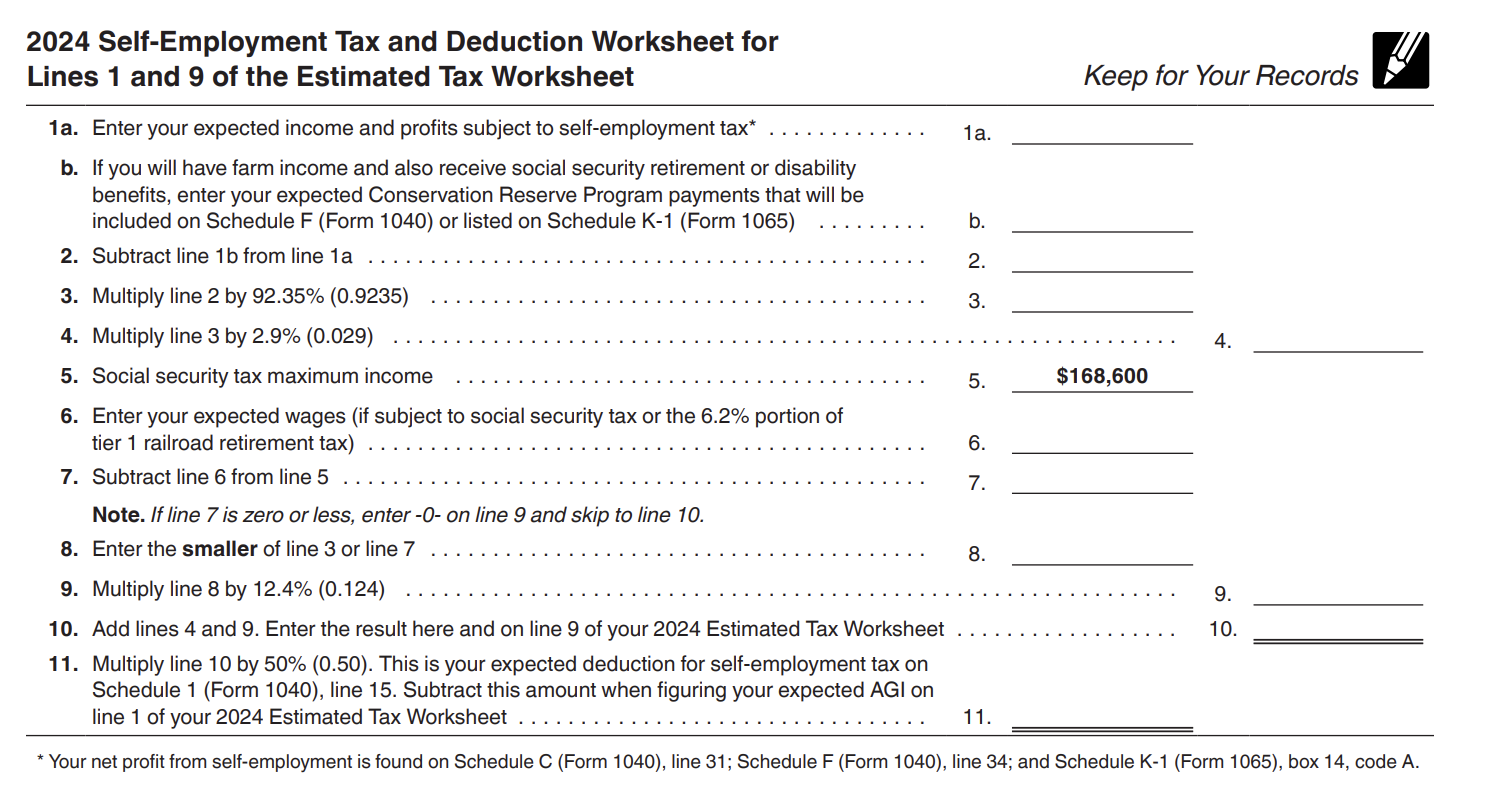

Source : www.eventbrite.comPublication 505 (2023), Tax Withholding and Estimated Tax

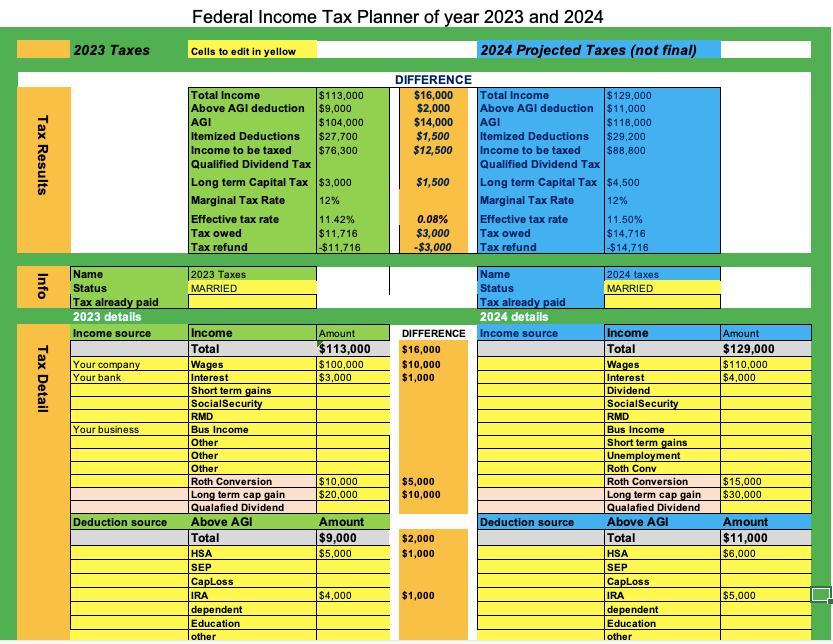

Source : www.irs.govExcel 2023 and 2024 Tax Planner spreadsheet,W2, self employed

Source : jamesbapps.shopFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comHave a tax situation that goes Fidelity Investments | Facebook

Source : m.facebook.comTax Updates What to expect for 2023 taxes and what’s coming in 2024

Source : www.juliemerrill.me2024 Schedule 1 2024 Self-Employment Tax Estimated Taxes, Due Dates and Safe Harbor Tax Rules (2024): There are benefits to being freelance from a tax perspective, but also challenges. Read on to see how to proceed once you make the decision to go freelance. . If you’re required to pay quarterly estimated taxes (such as those who are self-employed their taxes for the 2023 tax year on Jan. 29.. You can use the schedule chart below to estimate .

]]>